Hey SHIFT Community, here’s your update on all things SHIFT.

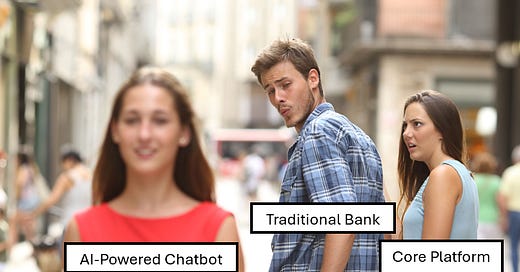

As per usual, here’s a meme to keep you smiling throughout the week.

“Sure, the legacy platform is on fire, but have you seen what GenAI can do to our FAQs?”

SHIFT Updates

🚀 Ignite applications are still open for 2025! However the deadline is fast approaching on the 25th April. The exclusive incubator programme, lasting 3-6 months, provides capital, tailored support, mentorship and strategic partnership opportunities. SHIFT encourages applications from all types of Fintech innovators ready to turn their concepts into reality.

🛍️ SHIFT will be at the Building Societies Annual Conference on the 7th & 8th May in Birmingham. We’re super excited for the following Fintechs to be joining us on the SHIFT stand: D·One, Doshi, Eleos, FintechOS, Nivo, Wollette. If you’ll be attending the conference, let us know and drop by Stand 7 to say hi!

👟 SHIFT will be attending the FCA Open Finance Spint 2025 on the 27th & 28th March at the FCA’s head office in Stratford, London. This sprint aims to inform thinking and shape the future technological and regulatory framework for open finance.

💸 SHIFT will also be appearing at Pay360 on the 25th March to meet with familiar SHIFT faces and connect with new ones, whilst joining in the discussion on payment innovation and seeing how to take Open Finance to the next level. If you’re attending let us know - it would be great to meet up!

Member Updates

👋 Some awesome new SHIFT members, so make sure to say hi on Slack:

James Hirst, Co-Founder & COO of Tyk, an API management platform that works with a large number of banks and mutuals, in the UK and overseas, providing the software that secures, scales and gives visibility into their API layer.

Adam Armer, Sales Director at Doconomy, who work with financial institutions to provide comprehensive financial sustainability & engagement platforms that helps businesses deliver responsible banking and finance tools, all backed by behavioral science and climate expertise.

🚀 Lloyds launch innovation programme is still open: Lloyds 12-week collaborative innovation programme focussed on delivering a faster route to experimentation with potential partners. If you were unable to make the last Q&A session on the 18th, you can find the notes on the #general Slack channel. Deadline: 4th April 2025.

If you have news that you want to be included here then make sure to post it in the #news-and-views channel on Slack or tag Kyle in your posts!

Partner Updates

🎤 Tech London Advocates are hosting an Open Mic event on the 26th March from 18:00 at The Club Space, Monument. The evening will cover 3 talks from experts on a range of topics from practical marketing tips, the practicalities of GenAI, and the power of smart data.

🎆 Power50 Wrap Up Party for Pay360 also on the 26th March from 18:00 onwards, at the Blue Marlin Ibiza London. The evening will extend networking opportunities from the conference in a relaxed atmosphere with music, drinks and snacks.

Resource Recommendation

Carta’s Founder Ownership Report 2025

This report uses anonymised data from more than 45,000 startups incorporated between 2015 - 2024 to shed new light on how founder ownership works across the U.S. venture ecosystem. This report digs into Carta’s unique data on: the composition of founding teams, how founding teams divide their initial pool of equity, and how equity ownership evolves as startups move through their fundraising journeys.

Key findings:

Solo Founder Odds: Solo founders are becoming more common (more than doubled in the last decade) but less likely to raise VC compared with founding teams. Despite solo founders representing 35% of startups in 2024, they accounted for just 17% of all companies launched in 2024 that also closed a VC round before the end of the year.

Early Dilution: After a seed round, a founding team holds 56% ownership (median); by Series A it’s only 36% (and 23% by Series B). Investors typically own 50% by Series A, so founders lose majority control quickly.

Equity Split Trends: Co-founders are splitting equity more evenly. In 2024, 46% of two-founder teams chose a 50/50 split (up from 32% in 2015). Solo founders start with 100%, but having no co-founder can make fundraising harder.

Co-Founder Team Resiliance: 75% of two-founder teams are still together 4 years on. The frequency of founder splits increases a bit with each ensuing year, but even after eight years, more than 60% of two-founder teams are still together.

Fintech vs. Other Sectors: Fintech founders generally keep more ownership than peers in capital-heavy sectors. Digital Fintech startups need less upfront capital, so founders face slightly less dilution than those in hardware or biotech.

If there are any resources you find enjoyable, useful, or interesting then let me know :)